Union Budget 2026-27 – Key Highlights Ministry of Finance HIGHLIGHTS OF UNION BUDGET 2026-27 Posted On: 01 FEB 2026 1:08PM…

Read More

Union Budget 2026-27 – Key Highlights Ministry of Finance HIGHLIGHTS OF UNION BUDGET 2026-27 Posted On: 01 FEB 2026 1:08PM…

Read More

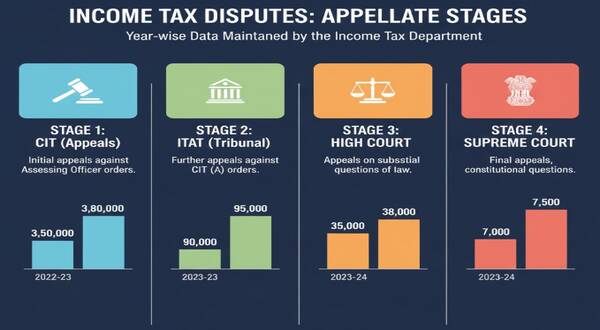

Income Tax Department maintains year-wise data of Income Tax Disputes at various appellate stages GOVERNMENT OF INDIA MINISTRY OF FINANCE…

Read More

Enactment of Income-tax Act, 2025 to Replace Income-tax Act, 1961 GOVERNMENT OF INDIA MINISTRY OF FINANCE DEPARTMENT OF REVENUE LOK…

Read More

One Nation, One Tax : Simplifying India’s Tax Structure Sabha Secretariat ONE NATION, ONE TAX HAS MADE TAX STRUCTURE ACROSS…

Read More

Income tax return via use of Artificial Intelligence tools GOVERNMENT OF INDIA MINISTRY OF FINANCE DEPARTMENT OF REVENUE LOK SABHA…

Read More

Finance Ministry Extends NPS Tax Benefits to Unified Pension Scheme (UPS) In a significant move aimed at strengthening the Unified…

Read More

Tax Benefits of NPS Extended to Unified Pension Scheme (UPS) Ministry of Finance वित्त मंत्रालय Tax benefits available under NPS…

Read More

Income-tax (Nineteenth Amendment) Rules, 2025: Key Changes and Implications The Income-tax (Nineteenth Amendment) Rules, 2025, introduced by the Government of…

Read MoreDPIIT Approves 187 Startups for Tax Relief Under Revised Section 80-IAC, Extending Eligibility to 2030 In a significant advancement for…

Read More

Streamlining the Income Tax Bill of 2025: Key Changes and Implications The Income Tax Bill of 2025 aims to simplify…

Read More