Introducing the Universal Pension Scheme: Voluntary Contributions for Retirement Benefits

GOVERNMENT OF INDIA

MINISTRY OF LABOUR AND EMPLOYMENT

LOK SABHA

UNSTARRED QUESTION NO. 4002

TO BE ANSWERED ON 18.08.2025

PENSION SCHEMES

SHRI PRAVEEN PATEL

SHRI PRADEEP KUMAR SINGH

state: Will the Minister of LABOUR AND EMPLOYMENT be pleased to

(a)whether there are any measures taken by the Government to increase the pension amount under the Employees Pension Scheme (EPS), and the measures are in place to ensure that all eligible workers are aware of its benefits, if so, the details thereof; (b)the details of the members enrolled under the Pradhan Mantri Shram Yogi Maan-Dhan (PM-SYM) scheme;

(c)whether the Government is planning to launch a separate pension scheme for Gig and Platform Worker and if so, the details thereof;

(d)whether the Government is planning to announce a Universal Pension Scheme to allow the people to contribute voluntarily and receive pension benefits after retirement and if so, the details thereof; and

(e)whether there is any plans to integrate existing pension schemes like the Pradhan Mantri Shram Yogi Maandhan (PM-SYM) and the National Pension Scheme (NPS) for Traders and Self Employed (NPS-Traders) and if so, the details thereof?

ANSWER

MINISTER OF STATE FOR LABOUR AND EMPLOYMENT

(SUSHRI SHOBHA KARANDLAJE)

(a): The EPS, 1995 is a “Defined Contribution-Defined Benefit” Social Security Scheme. The corpus of the Employees’ Pension Fund is made up of (i) contribution by the employer @ 8.33 per cent of wages; and (ii) contribution from Central Government through budgetary support @ 1.16 per cent of wages up to an amount of Rs. 15,000/- per month.

All benefits under the scheme are paid out of such accumulations. The fund is valued annually as mandated under paragraph 32 of EPS, 1995 and as per the valuation of the fund as on 31.03.2019, there is an actuarial deficit.

However, the Government is providing a minimum pension of Rs. 1000 per month to the pensioners under the EPS, 1995 by providing budgetary support, which is in addition to the budgetary support of 1.16 per cent of wages provided annually towards EPS to Employees’ Provident Fund Organisation (EPFO).

The measures taken to ensure that all eligible workers are aware of its benefits are at Annexure.

(b) to (e) The number of beneficiaries enrolled under the Pradhan Mantri Shram Yogi Maan-dhan (PM-SYM) scheme are 51,36,578 (including bulk registration of 5,06,603 beneficiaries) as on 10.07.2025.

For the first time, the definition ‘gig workers’ and ‘platform workers’ and provisions related to the same have been provided in the code on social security, 2020 which has been enacted by the Parliament. The Code provides for framing of suitable social security measures for gig workers and platform workers on matters relating to life insurance, health and maternity benefits, old age protection, etc

Annexure

Annexure referred to reply to Part (a) of Lok Sabha Unstarred Question No. 4002 to be answered on 18.08.2025 Steps being taken to raise awareness among eligible workers are given below.

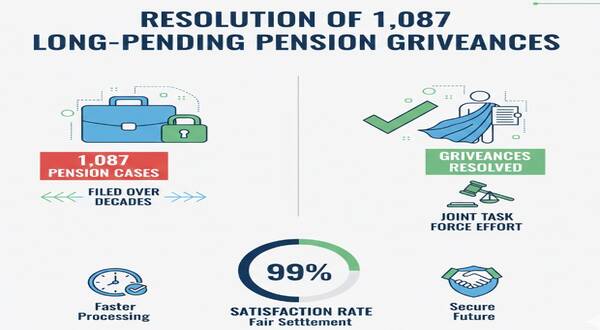

Nidhi Aapke Nikat -2.0: Nidhi Aapke Nikat 2.0 was launched to increase accessibility and visibility of the organization, in all the districts of the country, with regular periodicity. The Nidhi Aapke Nikat 2.0 is a grievance redressal platform and an information exchange network between EPFO and its various stakeholders. Under the Nidhi Aapke Nikat 2.0, EPFO is organizing camps at the district level on the 27th of every month or the next day in case of a holiday.

Educative Videos: To educate our stakeholders, EPFO releases one short film every Friday at 6 PM on the YouTube channel @socialepfo. Example – Videos on EPF Scheme and Types of EPF Advances, EPF Transfer from exempted to un – exempted, Nidhi Aapke Nikat 2.0 etc These videos educates our subscribers from every sector including MSME sector to use their PF fund judiciously. These videos have simple graphics and clear language for easy understanding for the general public.

Weekly Webinars: Field Offices are conducting Webinars to create awareness and educate various stakeholders of EPFO. Webinars are conducted weekly on topics related to EPF & MP Act 1952. Pensioners, Employees and employers along with other stakeholders participate in these webinars.

Social Media Activities: C&PR Division is entrusted with the responsibility of educating and making the stakeholders aware through social media by posting creatives, cartoons, GIFs and videos on Facebook, Twitter, Public App, Instagram and YouTube regularly. These creative materials creates awareness on new initiatives and latest developments in the Organization.

You Tube live session: It is conducted on second Tuesday of every month .The objective of these live sessions is educating general public and replying their queries along with gathering important feedback from stakeholders . Live sessions have been conducted on topics like Digital Services, EPS 95 , Freezed Accounts etc.

Regional Youtube Channels: Regional You Tube channels have been started to facilitate dissemination of information in local language of the region. Educative content is translated into regional language and posted on the Regional You Tube channels.

Press Briefs: Press Briefs are important tool for communication with stakeholders. Regular press releases ensure that new initiatives and any changes in EPFO are communicated to the general public and the media.

नोट :- हमारे वेबसाइट www.indiangovtscheme.com पर ऐसी जानकारी रोजाना आती रहती है, तो आप ऐसी ही सरकारी योजनाओं की जानकारी पाने के लिए हमारे वेबसाइट www.indiangovtscheme.com से जुड़े रहे।