Enactment of Income-tax Act, 2025 to Replace Income-tax Act, 1961

GOVERNMENT OF INDIA

MINISTRY OF FINANCE DEPARTMENT OF REVENUE

LOK SABHA

UNSTARRED QUESTION NO. 1224

TO BE ANSWERED ON MONDAY, DECEMBER 8, 2025/AGRAHAYANA 17, 1947 (SAKA)

NEW INCOME TAX RETURN FORMS

Shri Sudheer Gupta

Shri Chavan Ravindra Vasantrao

Shri Dhairyasheel Sambhajirao Mane

Will the Minister of FINANCE be pleased to state:

(a) whether the Government proposes to release the new Income-Tax Return (ITR) forms and related rules under the simplified Income Tax Act, 2025 by January 2026;

(b) if so, the details thereof along with the salient features and objectives;

(c) whether the Government has consulted tax experts, industry bodies and other stakeholders before finalising the new rules and forms;

(d) if so, the details thereof and the response of the Government thereto;

(e) the steps taken/proposed to be taken by the Government to ensure that the simplified ITR forms are user-friendly and reduce the compliance burden on taxpayers; and

(f) the manner in which tax payers benefit from the simplified ITR framework in terms of filing process, assessment mechanisms and taxpayer services?

ANSWER

MINISTER OF STATE IN THE MINISTRY OF FINANCE

(SHRI PANKAJ CHAUDHARY)

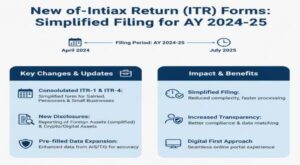

(a) & (b): Income-tax Act, 2025 (“the Act”) has been enacted on 21st August, 2025 to replace the existing Income-tax Act, 1961. The Income-tax Act, 2025 is slated to be effective from tax year 2026-27. Further, in consequence of the enactment of the said Act, notification of the consequent Rules and Forms are in the process of being notified.

In the context of Income-tax Return (ITR) forms, consolidation and simplification of the ITR forms, which is required to be made effective for the Assessment Year 2026-27, are in process as they will be notified as per provisions of Income-tax Act, 1961. Furthermore, ITR forms relating to Income-tax Act, 2025 will require the changes in consequence of amendments to the said Act made during Budget, 2026, and, accordingly, ITRs pertaining to the first tax-year 2026-27 shall be notified prior to FY 2027-28.

(c) to (f): Committee formulated by the CBDT on simplification of Income Tax Returns is carrying out extensive consultations with tax experts, institutional bodies, and field formations of the Income-tax Department. The committee is in process of formulating the ITR Forms, outcome thereof, will be reflected later in the notified forms.

नोट :- हमारे वेबसाइट www.indiangovtscheme.com पर ऐसी जानकारी रोजाना आती रहती है, तो आप ऐसी ही सरकारी योजनाओं की जानकारी पाने के लिए हमारे वेबसाइट www.indiangovtscheme.com से जुड़े रहे।