Gross Direct Tax collections for Financial Year (FY) 2023-24 register a growth of 18.74% : FY 2023-24 sees a robust…

Read More

Gross Direct Tax collections for Financial Year (FY) 2023-24 register a growth of 18.74% : FY 2023-24 sees a robust…

Read More

Tax-Saving Investments: Full list of tax-saving schemes as current financial year set to end Effective tax planning minimizes tax liabilities,…

Read More

Indira Gandhi Pyari Behna Samman Nidhi Yojana In India, various state governments have launched several welfare schemes for women. These…

Read More

Maximizing Tax Savings for FY 2023-24: Strategies and Opportunities Tax-saving strategies for FY 2023-24 deadline (March 31, 2024) include home…

Read More

Advance Tax e-campaign for F.Y. 2023-24 आयकर विभाग वित्त वर्ष 2023-24 के लिए अग्रिम कर ई-अभियान के लिए ई-अभियान चलाएगा…

Read More

Ministry of Finance, Department of Revenue, Central Board of Direct Taxes, New Delhi, amends Income-tax Rules, 1962. Includes changes in…

Read More

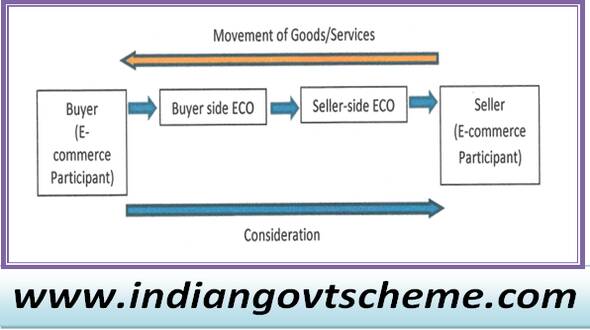

Income-Tax : E-commerce operators (ECOs) must deduct 1% income tax on the gross amount of goods or services sold through…

Read MoreIncome Tax Department आयकर विभाग ने डिजिटल मार्केटिंग और अपशिष्ट प्रबंधन के व्यवसाय से जुड़े समूहों पर तलाशी अभियान चलाया…

Read More