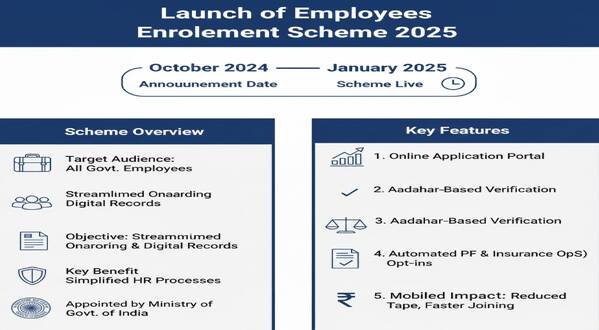

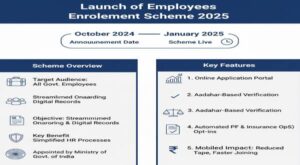

Launch of Employees Enrolment Scheme 2025

GOVERNMENT OF INDIA

MINISTRY OF LABOUR AND EMPLOYMENT

RAJYA SABHA

UNSTARRED QUESTION NO. 576

TO BE ANSWERED ON 04.12.2025

LAUNCH OF EMPLOYEES’ ENROLMENT SCHEME 2025

576. SHRI NARHARI AMIN:

Will the Minister of Labour and Employment be pleased to state:

(a) the details and objectives of the Employees’ Enrolment Scheme 2025 launched by Government;

(b) the eligibility criteria and scope of the scheme;

(c) the salient features and benefits provided to employers and employees; and

(d) the manner in which this initiative is expected to enhance transparency and formalize the workforce?

ANSWER

MINISTER OF STATE FOR LABOUR AND EMPLOYMENT

(SUSHRI SHOBHA KARANDLAJE)

(a): The Employees’ Enrolment Campaign-2025 provides a special window for employers to voluntarily enroll eligible employees who were left out from EPF coverage between 1st July, 2017 and 31st October, 2025, and to regularize their past compliance under the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952.

(b): Eligibility Criteria & Scope: Left out employees who joined the establishment between 1st July 2017 and 31st October 2025 and are alive and currently working under the concerned establishment.

(c): Salient Features: (i) The scheme is operational for 6 months, from 1st November 2025 to 30th April, 2026.

(ii) Employee share of contributions is waived in respect of such declared employees, if such share is not deducted from Salary.

(iii) Employer is to remit employer’s share, interest on arrears, Administrative Charges and lump-sum ₹100 penal damages per establishment.

(iv) The establishments facing inquiry under section 7A of the EPF & MP Act, 1952/ Para 26B of the EPF Scheme, 1952/ Para 8 of the EPS Scheme, 1995, are also eligible to avail benefit of the scheme, by limiting the Penal Damages to Rs. 100 per establishment. However, under such circumstances, the employer is required to pay all other dues including the employer’s share, the employees’ share, the administrative charges and interest on arrears.

(d): The enrolment is done only through online portal and verification is undertaken using Face Authentication Technology (FAT) for ensuring transparency. The coverage of such left-out employees will enhance transparency, formalize the workforce and bring more employees under the ambit of social protection.

नोट :- हमारे वेबसाइट www.indiangovtscheme.com पर ऐसी जानकारी रोजाना आती रहती है, तो आप ऐसी ही सरकारी योजनाओं की जानकारी पाने के लिए हमारे वेबसाइट www.indiangovtscheme.com से जुड़े रहे।