Tax-Saving Investments: Full list of tax-saving schemes as current financial year set to end Effective tax planning minimizes tax liabilities,…

Read More

Tax-Saving Investments: Full list of tax-saving schemes as current financial year set to end Effective tax planning minimizes tax liabilities,…

Read More

Indira Gandhi Pyari Behna Samman Nidhi Yojana In India, various state governments have launched several welfare schemes for women. These…

Read More

Maximizing Tax Savings for FY 2023-24: Strategies and Opportunities Tax-saving strategies for FY 2023-24 deadline (March 31, 2024) include home…

Read More

Advance Tax e-campaign for F.Y. 2023-24 आयकर विभाग वित्त वर्ष 2023-24 के लिए अग्रिम कर ई-अभियान के लिए ई-अभियान चलाएगा…

Read More

Ministry of Finance, Department of Revenue, Central Board of Direct Taxes, New Delhi, amends Income-tax Rules, 1962. Includes changes in…

Read More

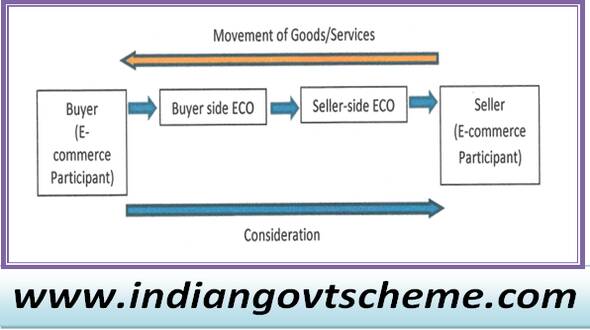

Income-Tax : E-commerce operators (ECOs) must deduct 1% income tax on the gross amount of goods or services sold through…

Read MoreIFSC Banking Unit Definition in Sub-Rule Clarified : Income-Tax Twenty Fourth Amendment Rules, 2023 MINISTRY OF FINANCE (Department of Revenue)…

Read MoreInsurance Premiums to investment in parents’ name : 5 ways to save income tax Introduction Investing in insurance policies in…

Read MoreApplication under sub-section (20) of section 155 for credit of tax deduction at source (TDS) : Income-Tax(Twentieth Amendment) Rules, 2023…

Read MoreIncome-Tax (Ninteenth Amendment) “FORM No. 6C Rules 2023 MINISTRY OF FINANCE (Department of Revenue) (CENTRAL BOARD OF DIRECT TAXES) NOTIFICATION…

Read More