8th Central Pay Commission: Key Updates on Pension Eligibility and Reforms

The 8th Central Pay Commission (CPC) is poised to introduce significant reforms to the salary and pension structure for central government employees and pensioners. With over 5 million current employees and 6.5 million pensioners eagerly awaiting these changes, the 8th CPC represents a crucial update in the realm of pay commissions. This revision aims to ensure fair compensation and financial security for those dedicated to public service.

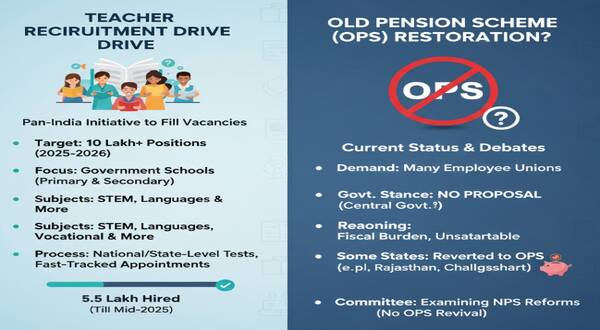

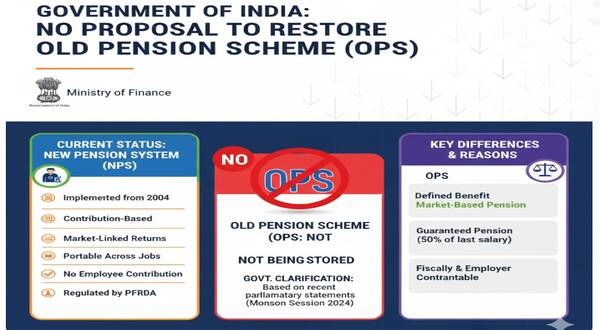

Pension Eligibility Concerns for Pre-2026 Retirees

A primary concern among retirees is whether those retiring before January 1, 2026, will be eligible for full benefits under the 8th CPC. Media speculation has suggested a potential division between:

- Pensioners retiring before January 1, 2026

- Pensioners retiring on or after January 1, 2026

This speculation has led to anxiety among soon-to-be retirees, largely stemming from misinterpretations of the Finance Bill 2025 regarding retirement policies.

Government Clarification on Pensioners’ Eligibility

In response to growing concerns, Finance Minister Nirmala Sitharaman addressed the issue in the Rajya Sabha, stating that:

- The amendments in the Finance Bill 2025 validate existing pension regulations.

- No new provisions have been introduced that would reduce or deny entitlements for pensioners.

- The government remains committed to ensuring parity, similar to the approach taken during the 7th Pay Commission.

This clarification reassures retirees that those opting for retirement before 2026 will not be disadvantaged.

Legal Framework Supporting Pension Reforms

The Finance Bill 2025, passed on March 25, 2025, grants the government the legal authority to:

- Establish pension regulations based on Pay Commission recommendations.

- Implement distinctions among pensioners if logically derived from commission reports.

- Apply such rules retroactively from June 1, 1972.

This legislative power allows for administrative flexibility while maintaining fairness for existing pensioners, comprehensively addressing potential eligibility concerns.

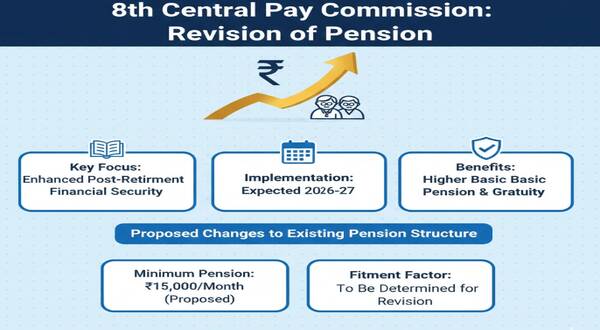

Anticipated Changes in Pay and Pension Structures

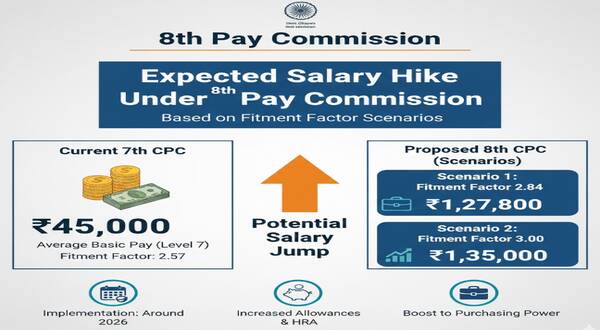

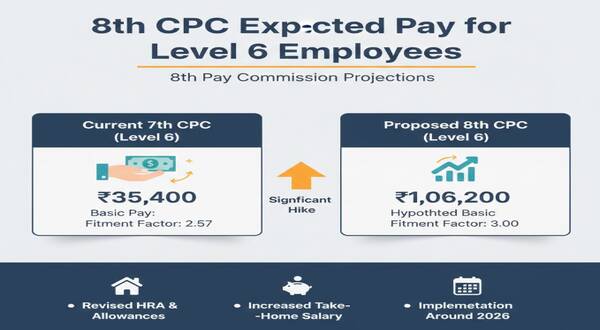

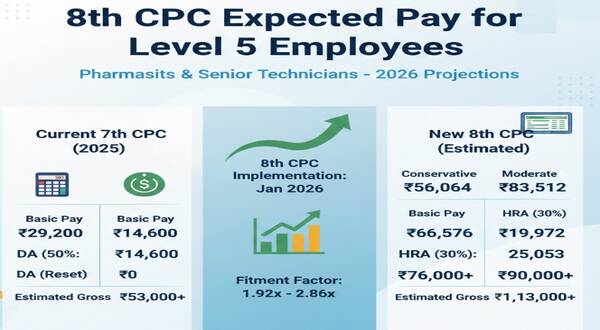

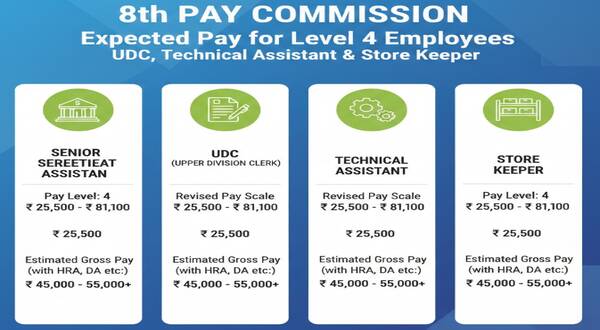

The 8th CPC is expected to revise the fitment factor, which is vital for salary and pension calculations. Current projections indicate:

- Current minimum basic pay: ₹18,000

- Current minimum pension: ₹9,000

| Proposed Fitment Factor | Revised Minimum Basic Pay (₹) | Revised Minimum Pension (₹) | % Increase |

| 2.00 | 36,000 | 18,000 | 100% |

| 2.08 | 37,440 | 18,720 | 108% |

| 2.86 | 51,480 | 25,740 | 186% |

Under the 7th CPC, the fitment factor is currently set at 2.57x. While stakeholders propose a minimum factor of 2.0x, many advocate for a more substantial increase to better align with inflation and rising living costs. Importantly, retirement before 2026 will not preclude pensioners from benefiting from these enhancements.

Importance of Staying Informed

It is essential for pensioners to stay updated on these developments because:

- Pensioners depend heavily on retirement benefits for healthcare and daily expenses.

- Misinterpretations or delays in revised benefits can lead to financial stress.

- Assurance of equitable treatment fosters trust among generations of government retirees.

Key Takeaways for Pensioners Regarding the 8th CPC

- No confirmed division exists between pre-2026 and post-2026 retirees.

- The government guarantees equitable treatment for all pensioners.

- Revised pensions will reflect increased fitment factors, enhancing financial security.

- Final guidelines will be established following the 8th CPC’s official recommendations around January 2026.

Understanding these key points will help pensioners navigate the upcoming changes effectively, ensuring they are prepared for the benefits that lie ahead.

नोट :- हमारे वेबसाइट www.indiangovtscheme.com पर ऐसी जानकारी रोजाना आती रहती है, तो आप ऐसी ही सरकारी योजनाओं की जानकारी पाने के लिए हमारे वेबसाइट www.indiangovtscheme.com से जुड़े रहे।