8th CPC Pay Estimates Salary for Central Government Employees Impact of a 2.28 Fitment Factor

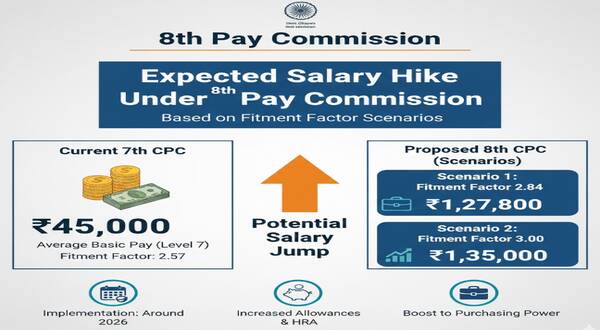

The 8th Pay Commission’s recommendations are eagerly awaited by central government employees, particularly those in the major pay bands of 5200, 9300, and 15600. With a proposed fitment factor of 2.28, let’s explore the projected revised total pay, allowances, and net salary for various levels of employees.

Current Context of Pay Commissions

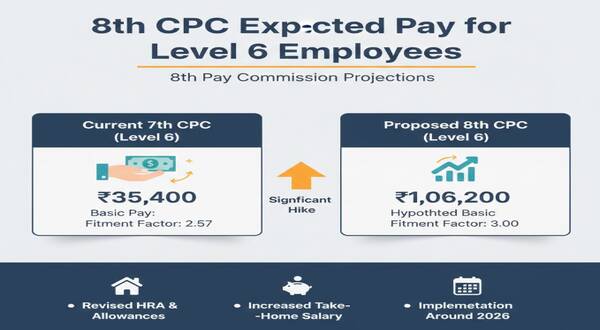

- 7th CPC (2016): Fitment factor of 2.57

- 6th CPC (2006): Fitment factor of 1.92

Speculations about the fitment factor for the 8th CPC vary, with some organizations advocating for as high as 3.86. The final decision on the fitment factor will significantly impact the salaries of government employees.

Projected Salary Estimates

Level 2 – PB 1 (GP 1900)

- Basic Pay: ₹23,800

- Projected Revised Salary: ₹54,264

- HRA (24%): ₹13,023

- TA: ₹1,350

- Gross Salary: ₹68,637

- NPS Contribution: ₹5,426

- CGHS Contribution: ₹250

- Net Salary: ₹62,961

Level 3 – PB 1 (GP 2000)

- Basic Pay: ₹24,500

- Projected Revised Salary: ₹55,860

- HRA (24%): ₹13,406

- TA: ₹3,600

- Gross Salary: ₹72,866

- NPS Contribution: ₹5,586

- CGHS Contribution: ₹250

- Net Salary: ₹67,030

Level 4 – PB 1 (GP 2400)

- Basic Pay: ₹30,500

- Projected Revised Salary: ₹69,540

- HRA (24%): ₹16,690

- TA: ₹3,600

- Gross Salary: ₹89,830

- NPS Contribution: ₹6,954

- CGHS Contribution: ₹250

- Net Salary: ₹82,626

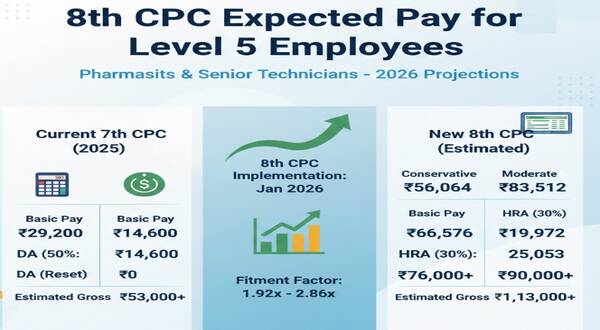

Level 5 – PB 1 (GP 2800)

- Basic Pay: ₹35,900

- Projected Revised Salary: ₹81,852

- HRA (24%): ₹19,644

- TA: ₹3,600

- Gross Salary: ₹1,05,096

- NPS Contribution: ₹8,185

- CGHS Contribution: ₹250

- Net Salary: ₹96,661

Level 7 – PB 2 (GP 4600)

- Basic Pay: ₹44,900

- Projected Revised Salary: ₹1,02,372

- HRA (24%): ₹24,569

- TA: ₹3,600

- Gross Salary: ₹1,30,541

- NPS Contribution: ₹10,237

- CGHS Contribution: ₹650

- Net Salary: ₹1,10,665

Level 8 – PB 2 (GP 4800)

- Basic Pay: ₹50,500

- Projected Revised Salary: ₹1,15,140

- HRA (24%): ₹27,634

- TA: ₹3,600

- Gross Salary: ₹1,46,374

- NPS Contribution: ₹11,514

- CGHS Contribution: ₹650

- Net Salary: ₹1,18,112

Level 10 – PB 3 (GP 5400)

- Basic Pay: ₹59,500

- Projected Revised Salary: ₹1,35,660

- HRA (24%): ₹32,558

- TA: ₹7,200

- Gross Salary: ₹1,75,418

- NPS Contribution: ₹13,566

- CGHS Contribution: ₹650

- Net Salary: ₹1,43,218

Level 12 – PB 3 (GP 7600)

- Basic Pay: ₹83,600

- Projected Revised Salary: ₹1,90,608

- HRA (24%): ₹45,746

- TA: ₹7,200

- Gross Salary: ₹2,43,554

- NPS Contribution: ₹19,061

- CGHS Contribution: ₹1,000

- Net Salary: ₹1,85,854

Conclusion

The projected salary estimates under the 8th Pay Commission reflect a significant increase in earnings for central government employees if a fitment factor of 2.28 is implemented. Along with basic salary adjustments, allowances such as HRA and TA will also see revisions, positively impacting the overall compensation package. The final implementation timeline and any additional changes will depend on the government’s announcements regarding the pay commission’s findings.

नोट :- हमारे वेबसाइट www.indiangovtscheme.com पर ऐसी जानकारी रोजाना आती रहती है, तो आप ऐसी ही सरकारी योजनाओं की जानकारी पाने के लिए हमारे वेबसाइट www.indiangovtscheme.com से जुड़े रहे।