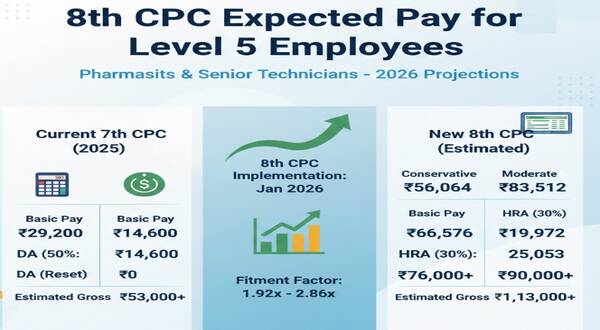

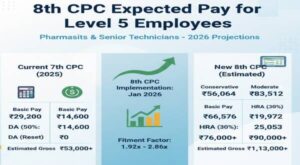

8th CPC Expected Pay for Level 5 Employees under the 8th Pay Commission for the post of Pharmacists or Senior Technicians

As the government prepares for the transition from the 7th to the 8th Pay Commission, Level 5 employees—a category that includes roles like Pharmacists or Senior Technicians—are set for a major salary overhaul.

With the Terms of Reference (ToR) for the 8th CPC officially notified in November 2025, and implementation expected on January 1, 2026, here is the projected salary breakdown for Level 5 employees.

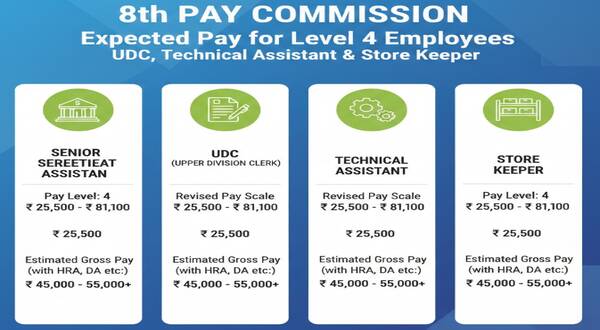

Projected Level 4 Basic Pay Scenarios

| Scenario | Fitment Factor | Estimated Level 5 Basic Pay |

| Conservative | 1.92 | ₹56,064 |

| Moderate | 2.28 | ₹66,576 |

| Optimistic | 2.86 | ₹83,512 |

The “Gross Salary” Components

A central government salary isn’t just basic pay. Several other factors will be recalculated based on the new 8th CPC scales:

- Dearness Allowance (DA): Upon implementation, the DA (which may reach 60%–70% by 2026) is typically merged into the basic pay and reset to 0%.

- House Rent Allowance (HRA): This is calculated as a percentage of your basic pay (e.g., 30% for X-class metro cities). A higher basic pay automatically leads to a much larger HRA.

- Transport Allowance (TA): This varies by level and city but is also expected to be upwardly revised.

Deep Dive Options

To help you plan for 2026, which of these areas should we examine next?

- City-Wise Gross Salary: Would you like to see a sample calculation of the total take-home pay (Basic + HRA + TA) for someone living in a metro city vs. a smaller town?

- Arrears and Timeline: If the implementation is delayed past January 2026 (as has happened with previous commissions), how does the government calculate back-pay?

The “Aykroyd Formula”: Are you interested in the scientific method the government uses to determine the minimum wage based on the cost of living?

Estimated Gross Monthly Salary (8th CPC)

While the basic pay is the foundation, the total “take-home” or gross salary includes various allowances. In the 8th CPC, the Dearness Allowance (DA) is expected to reset to 0% at the start, as the previous 70% DA will be merged into the base.

Below is an estimate for a Level 5 employee living in a Tier-1 (X-Class) city like Delhi or Mumbai:

| Component | Current (7th CPC) | Est. (1.92 Factor) | Est. (2.28 Factor) | Est. (2.86 Factor) |

| Basic Pay | ₹29,200 | ₹56,064 | ₹66,576 | ₹83,512 |

| DA (Estimated) | 50% – 55% | 0% (Reset) | 0% (Reset) | 0% (Reset) |

| HRA (Metro City) | ₹8,760 | ₹16,819 | ₹19,972 | ₹25,053 |

| Estimated Gross | ₹53,000+ | ₹76,000+ | ₹90,000+ | ₹1,13,000+ |

*Note: TA and other fixed allowances are subject to separate revision by the commission committee. These figures represent a potential 50-60% jump in gross earnings.

नोट :- हमारे वेबसाइट www.indiangovtscheme.com पर ऐसी जानकारी रोजाना आती रहती है, तो आप ऐसी ही सरकारी योजनाओं की जानकारी पाने के लिए हमारे वेबसाइट www.indiangovtscheme.com से जुड़े रहे।