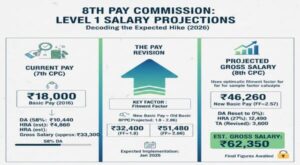

8th Pay Commission : Projections for the Revised Level 1 Minimum Basic Pay

The most critical factor for Level 1 employees is the revision of the minimum basic pay, which currently stands at ₹18,000 under the 7th CPC.

Basis of Minimum Pay:

The Aykroyd Formula The minimum pay is determined by calculating a need-based minimum wage, a principle adopted by the 15th Indian Labour Conference (ILC) in 1957. The 7th CPC used the Aykroyd Formula to establish the ₹18,000 figure, considering :

- Family Unit: A worker, their spouse, and two children (equaling 3 consumption units).

- Nutrition: Daily intake of 2,700 calories per consumption unit.

- Essentials: Cost of food, clothing (72 yards per annum per family), housing rent, and 20% for miscellaneous items (fuel, lighting, etc.).

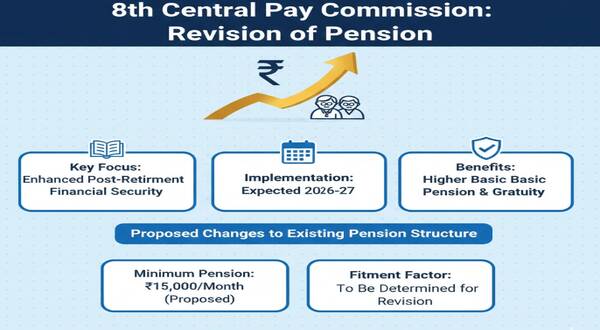

For the 8th CPC, the new minimum pay will be the ₹18,000 baseline adjusted for inflation since 2016 and potentially based on a revised 6-unit formula (to include dependent parents, as advocated by some unions) or a new balanced diet approach.

Projected Minimum Basic Pay Range

| Pay Matrix Level | Current Basic Pay (7th CPC) | Fitment Factor (FF) Range | Projected Basic Pay (8th CPC) |

| Level 1 | ₹18,000 | 1.8 to 2.86 | ₹32,400 to ₹51,480 |

The Crucial Multiplier:

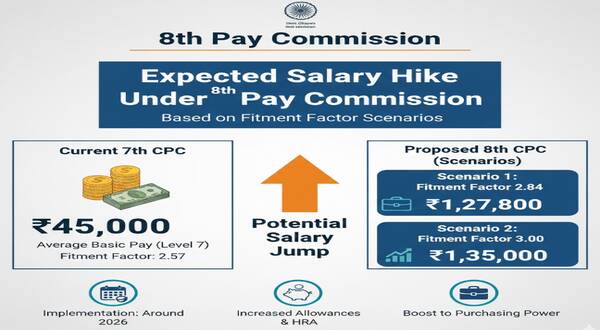

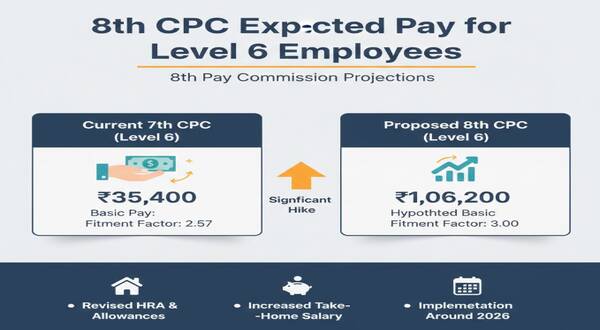

Fitment Factor (FF)The Fitment Factor (FF) is the multiplication number used to translate the current basic pay into the new basic pay. The final number will determine the actual hike.

New Basic Pay = Existing Basic Pay * Fitment Factor

Historical and Projected Fitment Factors

| Pay Commission | Year of Implementation | Fitment Factor Applied | Change in Minimum Pay |

| 6th CPC | 2006 | 1.86 | ₹3,050 to ₹7,000 |

| 7th CPC | 2016 | 2.57 | ₹7,000 to ₹18,000 |

| 8th CPC (Projected) | 2026 | 1.8 to 2.86 | ₹18,000 to ₹32,400–₹51,480 |

Illustrative Calculation for Level 1

Assuming an existing basic pay of ₹18,000 and an optimistic Fitment Factor of 2.57 (same as 7th CPC), the calculation for Level 1 would be:

New Basic Pay: ₹18,000 * 2.57 = ₹46,260

Estimated Gross Salary for Level 1

The overall monthly pay (Gross Salary) will increase substantially because all allowances are linked to the higher basic pay. The following is a sample projection based on the ₹46,260 new basic pay:

|

Component |

Calculation Basis | Amount (₹) |

| New Basic Pay | ₹18,000 $\times$ 2.57 | ₹46,260 |

| Dearness Allowance (DA) | Reset to 0% on implementation | ₹0 |

| House Rent Allowance (HRA) | 27% (Metro – X Class) | ₹46,260 $\times$ 27% = ₹12,490 |

| Travel Allowance (TA) | Revised Fixed Rate (e.g., ₹3,600 + 0% DA) | ₹3,600 |

| Estimated Gross Salary | Sum of above (excluding statutory deductions) | ₹62,350 |

| Current Gross Salary (Approx.) | (₹18,000 + DA @ 58% + Allowances) | ~ ₹34,110 |

The implementation of the 8th CPC will thus provide a significant financial uplift, protecting the real value of the salary against inflation.

नोट :- हमारे वेबसाइट www.indiangovtscheme.com पर ऐसी जानकारी रोजाना आती रहती है, तो आप ऐसी ही सरकारी योजनाओं की जानकारी पाने के लिए हमारे वेबसाइट www.indiangovtscheme.com से जुड़े रहे।