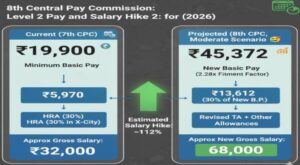

8th Pay Commission Projected Basic Pay and Salary Hike for Level 2

7th CPC Pay Structure for Level 2

The 7th CPC introduced the Pay Matrix, which replaces the old system of Pay Bands and Grade Pay. Level 2 falls into the lowest pay structure range.

- Basic Pay Range

- Entry/Initial Basic Pay: ₹19,900

- Maximum Basic Pay: ₹63,200

The pay progression from the minimum to the maximum is achieved through 40 stages within the level, with an annual increment of 3% applied horizontally on the matrix.

Historical Context

|

Parameter |

6th CPC (Old System) | 7th CPC (Current System) |

| Pay Band | PB-1 (₹5,200 – ₹20,200) | N/A(Subsumed) |

| Grade Pay (GP) | ₹1,900 | N/A(Subsumed) |

| Pay Level | N/A | Level 2 |

| Fitment Factor (Used to Convert) | N/A | 2.57 |

| Initial Basic Pay | (₹7,410 Pay in PB + ₹1,900 GP) = ₹9,310 | ₹19,900 |

Sample Gross Salary Calculation (Current)

A government employee’s Gross Salary is the sum of their Basic Pay and all applicable allowances. The allowances are generally calculated as a percentage of the Basic Pay.

Read also:- 8th Pay Commission 2025 : Fitment Factor May Reach 2.46, Salaries Could Rise by Up to 54%

Assumptions (For an employee at the initial stage of Level 2):

- Basic Pay (Initial): ₹19,900

- Dearness Allowance (DA): 50% (The current rate is 50% of Basic Pay, effective from Jan 2024, although the exact current rate may fluctuate based on the date)

- HRA (X City – 30%): 30% of Basic Pay

- TA (Lower Rate): ₹1,350 + DA on TA (50% of ₹1,350 = ₹675)

|

Pay Component |

Calculation | Amount (₹) |

| Basic Pay | – | 19,900 |

| DA | Rs. 19,900 * 50% | 9,950 |

| HRA (X City) | Rs.19,900 * 30% | 5,970 |

| TA | ₹1,350 + DA on TA (₹675) | 2,025 |

| Gross Salary | BP + DA + HRA + TA | 37,845 |

Note: The actual Net Salary would be lower due to deductions like NPS, Income Tax, CGHS, and other professional taxes.

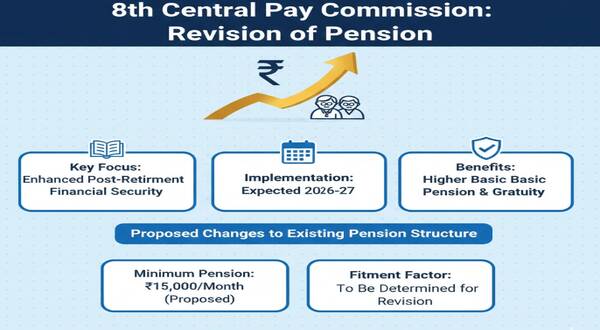

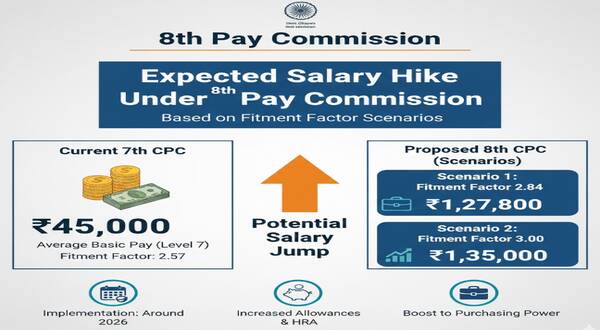

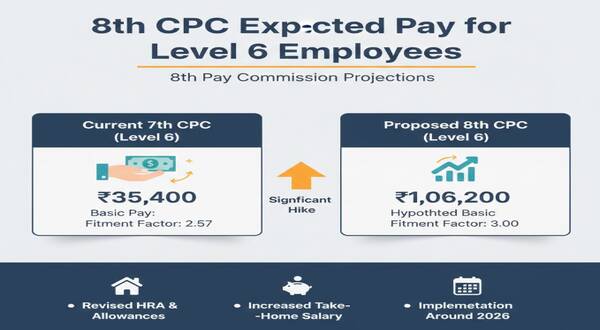

The official recommendations and pay matrix for the 8th Central Pay Commission (CPC) have not yet been published by the government. Therefore, any figures for Level 2 are currently projected and tentative based on anticipated fitment factors and previous commission trends.

The 8th CPC has been formally constituted, and its recommendations are generally expected to be implemented with effect from January 1, 2026.

Read also: 8th Pay Commission : Projections for the Revised Level 1 Minimum Basic Pay

Projected 8th CPC Basic Pay for Level 2

Projections are typically calculated by multiplying the current 7th CPC basic pay by an expected fitment factor.

|

Pay Component |

Current 7th CPC (Initial) | Projected 8th CPC (Scenario 1) | Projected 8th CPC (Scenario 2) |

| Pay Level | Level 2 | Level 2 | Level 2 |

| Current Basic Pay | ₹19,900 | ₹19,900 | ₹19,900 |

| Expected Fitment Factor | N/A (Previous 2.57) | 2.28 (Moderate) | 2.86 (Higher End) |

| Projected New Basic Pay | N/A | Rs.19,900 * 2.28 = Rs.45,372 | Rs. 19,900 * 2.86 = Rs. 56,914 |

Key Considerations for Total Pay

The Total Projected Pay (Gross Salary) would include the new Basic Pay plus various allowances, which are also subject to revision:

1. Dearness Allowance (DA):

- The current DA is likely to be merged with the Basic Pay when the 8th CPC is implemented.

- The new salary structure will then start with DA reset to 0% and increase biannually thereafter.

2. House Rent Allowance (HRA): Will be recalculated as a percentage of the New Basic Pay.

- X Cities (e.g., Metro): Likely 27%

- Y Cities (Tier 2): Likely 18%

- Z Cities (Tier 3): Likely 9%

3. Transport Allowance (TA): This allowance is also expected to be revised upwards.

Disclaimer: These are unofficial estimates and are subject to change based on the final report and government notification of the 8th Pay Commission.